Finding out the at-fault driver is uninsured can feel overwhelming—especially when you’re dealing with injuries, car repairs, and time off work. The good news is that you may still have options. In many cases, the most important next step is to review your own auto policy and confirm whether you have Uninsured Motorist (UM) coverage.

Below is a straightforward guide to what uninsured-driver accidents can look like in Little Rock, what you can do right away, and how people typically recover compensation when the at-fault driver has no insurance.

First, confirm the driver is actually uninsured

Sometimes a driver is “uninsured” only because they can’t produce proof of insurance at the scene. Other times, their policy lapsed, the insurer denies coverage, or the policy doesn’t apply to that specific driver or vehicle.

If police responded, the crash report can help confirm the insurance status. Even if you already suspect the driver is uninsured, it’s still smart to treat the situation like a standard injury claim: gather evidence, document symptoms, and don’t assume your insurer will automatically accept everything at face value.

What to do right away after an uninsured-driver crash

- Call 911 and request medical help if needed.

- Get the crash report or the report number and the responding agency.

- Take photos of vehicle positions, damage, plates, roadway conditions, and visible injuries.

- Collect witness information (names and phone numbers).

- Seek medical evaluation—especially for head, neck, or back symptoms that can worsen later.

Keep receipts and records from the start (towing, rental, medications, and missed work). Organized documentation makes it easier to prove both what happened and what the crash cost you.

How Uninsured Motorist (UM) coverage may help

In many uninsured-driver cases, the primary source of recovery is your own Uninsured Motorist (UM) coverage. UM is designed to compensate you for losses caused by an at-fault driver who doesn’t have liability insurance.

UM claims can still be contested

Even though the claim is through your own policy, insurance companies may still dispute key issues like fault, the seriousness of injuries, whether treatment was necessary, or the value of pain and suffering. That’s why evidence matters—especially photos, witness statements, and medical records that connect your symptoms to the crash.

Uninsured vs. underinsured: what’s the difference?

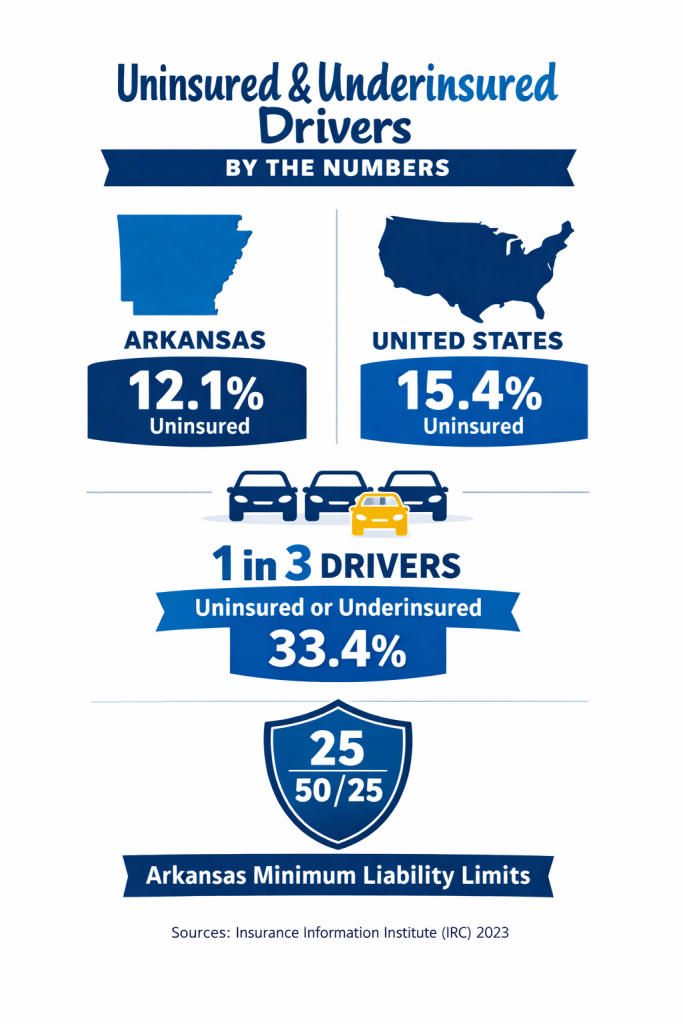

“Uninsured” means the at-fault driver has no liability insurance that applies. “Underinsured” generally means the driver has insurance, but their policy limits aren’t enough to cover the full value of your damages.

If the driver had some insurance, you may be dealing with Underinsured Motorist (UIM) coverage instead of (or in addition to) UM. The right approach depends on the facts and your policy language.

Other options that may help pay bills and repair your car

If UM doesn’t apply or isn’t enough, you may still have practical ways to cover costs while your claim is pending:

- Collision coverage for vehicle repairs (usually minus your deductible).

- Medical payments coverage (MedPay) if your policy includes it.

- Health insurance for treatment (with potential reimbursement considerations later).

- Claims against other responsible parties in unusual situations (for example, if another party contributed to the crash).

- Direct claims against the uninsured driver, though recovery can be limited if they have no assets or income.

Don’t delay: deadlines and early mistakes can cost you

Waiting too long can make it harder to obtain records, locate witnesses, and prove how the crash affected you. Insurance policies can also require timely notice and cooperation. If you’re dealing with injuries, uncertain coverage, or pushback from an insurer, getting advice early can help protect the value of your claim.

A simple 7-day checklist

-

-

- Get checked out and follow medical recommendations.

- Start a file for photos, receipts, and communications.

- Request the crash report and confirm the other driver’s insurance status.

- Notify your insurer and ask whether UM/UIM coverage may apply.

- Track symptoms daily (pain, sleep, mobility, headaches, anxiety).

- Document missed work and any job limitations.

- Avoid quick settlements until you understand your injuries and future needs.

-

When to talk with a Little Rock car accident lawyer

Consider speaking with a lawyer if you have significant injuries, there’s a dispute about fault, the insurer pushes a fast settlement, or you’re unsure what coverage applies. Uninsured-driver claims can become complicated quickly—especially when multiple coverages, medical billing issues, or long-term treatment are involved.

Learn more about your options here: Little Rock car accident attorney.